Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

TurboTax is a trusted name in financial software. They are owned by Intuit, which also owns QuickBooks and Mint. If you are looking for easy-to-use software backed by a trustworthy brand TurboTax might be just what you need.

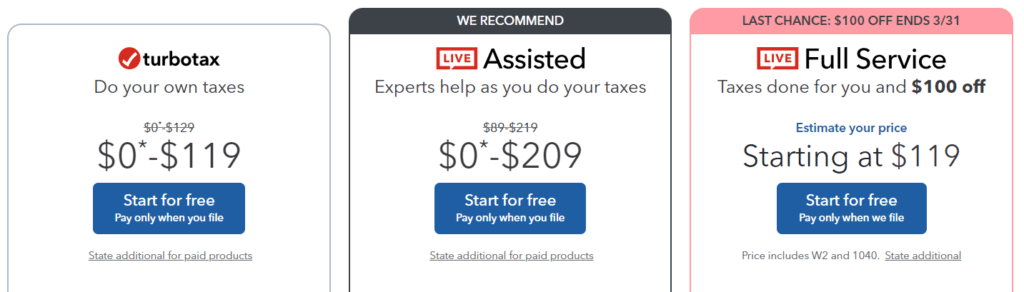

They offer several different service levels. You can do it yourself, where the software walks you through each step, asking questions and doing the calculations. You can also get access to a tax expert when you have questions. If you want the most support, you can have a TurboTax tax expert do your taxes.

TurboTax Review Pricing and Plans

The first decision to make is how much help you want. TurboTax has three levels of support: DIY, TurboTax Assisted, and Full Service. If you aren’t sure, you can start with DIY and then upgrade if you need expert help. You don’t pay until you file, so you can play around with the software and see what works for you.

- DIY: If you are comfortable paying taxes, the DIY plans will be the perfect fit.

- Assisted: If you want to do them yourself but also want a human advisor who can answer tax questions, then TurboTax Assisted is for you.

- Full Service: However, if you want to leave the whole thing to a professional, Full Service is the support level you’ll need.

TurboTax Free Edition

- DIY: $0 for both federal and state

- Assisted: $89 for federal and state (This plan is called Basic if you add the Assisted support.)

- Full Service: $219 for federal and $54 for each state return

TurboTax Free Edition is for users with simple tax returns only, not all taxpayers will qualify. You can easily prep, print, and e-file both your federal and state income taxes for free.

It comes with many of the features of paid plans including the ability to find your W-2 information automatically if you work for a relatively large employer or you can upload your W-2 by taking a photo of it with your smartphone. You’ll also get guidance in case of an audit, and 24/7 answers to tax questions in the online community of TurboTax specialists and customers.

To qualify for TurboTax Free, your tax situations are limited to:

- W-2 income

- Limited 1099-INT or 1099-DIV income

- Claiming the standard deduction

- Earned Income Tax Credit (EIC)

- Child tax credits

- Student loan interest deduction

If you take the standard deduction and you’re employed by someone else with or without children, then TurboTax Free is probably a good choice for you.

If you want to itemize, have 1099 income, own rental property, sold crypto, had a lot of dividend income, or anything complicated you’ll likely need to upgrade.

You can upgrade this plan from Free or Basic Live to Full Service for an additional cost.

TurboTax Deluxe

- DIY: $39 for federal and $39 for each state return

- Assisted: $139 for federal and $54 for each state return

- Full Service: $269 for federal and $54 for each state return

Deluxe includes everything for Free and includes the ability to itemize. Even if you’re claiming the standard deduction, there are plenty of deductions and credits you can claim that aren’t covered in TurboTax Free. These include deductions for mortgage and property taxes, education tax credits, retirement contributions, and charity donations.

If you don’t know whether you should itemize or take the standard deduction, TurboTax will go through your Schedule A form and determine whether you should take the standard deduction or itemize. It searches over 350 deductions and credits to maximize your return.

It also gives you access to Schedule C and Schedule SE. These are the forms for profit or loss from your business and the self-employment tax. You can use these forms when you have business income but no business expenses. This is great for side hustlers in the gig economy or part-time freelancers.

TurboTax Premier

- DIY: $89 for federal and $39 for each state return

- Assisted: $169 for federal and $54 for each state return

- Full Service: $379 for federal and $54 for each state return

If you’re investing above and beyond your retirement accounts, then you’ll need TurboTax Premier. Premier covers everything included in Deluxe, but it also covers Schedule E.

Schedule E is used to record income and expenses related to rental properties. If you’re a landlord, you’ll need this option to claim tax deductions on your rental property. TurboTax will also help you set up new rentals, calculate and report depreciation, and determine the fair market value of your properties.

Premier also lets you deduct points and appraisal fees if you refinance your home so even if you don’t own an investment property you could save money on taxes by using the Premier plan.

TurboTax Self-Employed

- DIY: $129 for federal and $59 for each state return

- Assisted: $219 for federal and $64 for each state return

- Full Service: $409 for federal and $64 for each state return

TurboTax Self-Employed is for contractors, freelancers, and small business owners. It includes everything in the Premier version, plus Schedule C, and you deduct business income and expenses. Deluxe also gives you access to Schedule C without the option to deduct expenses.

You’ll want to choose Self-Employed if you have expenses or are dealing with asset depreciation.

TurboTax searches industry-specific deductions, offers one-on-one help from self-employment specialists, and helps you figure out expenses like standard vs. actual mileage and deducting a home office. You can also import your 1099-MISC by taking a picture of it with your smartphone.

One interesting feature of this version is that it lets you import your business’s information directly from QuickBooks Self-Employed. If you already use the accounting software to track expenses, mileage, and more, you can pull that data right to your TurboTax account.

How TurboTax Works

More than anything, users praise TurboTax for its interface. It’s clean and easy to use. Plus it walks you through each part of the process step-by-step. TurboTax provides the right level of support without begin too in-your-face with tips, tricks, and tutorials.

When you log in to do your taxes, you can do each step in order or skip around to the steps you want to work on. This is convenient when you have various W-2s and 1099s coming in at different times. You don’t have to worry about missing anything because TurboTax won’t let you file without double-checking each step.

One convenient feature of TurboTax is that if you’ve used the software before, it will import your most recent information. If not much has changed, you may not have to enter any personal information. Just double-check it and call it done.

TurboTax will also allow you to pull in information from W-2 and 1099 forms if they match last year’s forms. If your employer or contract clients stay the same, TurboTax will pull in the employer’s name and EIN. Then it’ll walk you through filling in the information from those W-2s or 1099s.

If you work for a participating employer, TurboTax can automatically pull in information from your W-2s. Again, this is a nice time-saving step. If you can’t find the information, it’ll tell you which box to look at on each tax form page. Then, the software will guide you through questions to fill out each part of your taxes.

Additional Benefits

Each level of TurboTax gives you access to additional tax forms, custom prompts, and fill-in-the-blanks to assist you in filing those forms. But all versions also come with additional benefits, including:

- W-2 Auto Fill: If you work for a relatively large employer, chances are that TurboTax can find your W-2 information for you automatically. This doesn’t work with every employer, but it is handy for some.

- E-File: E-filing keeps you out of the super-long post office line in early April. It may get you a refund faster, too. Typically, you can e-file both your federal and state taxes, though filing state taxes may cost more.

- 24/7 Access: TurboTax gives you access to your tax forms all the time online. This makes it easy to print off additional copies of your tax returns if you’re buying a home or filling out other major paperwork in the coming years.

Audit Support

Once you’re done with your taxes, you can run an audit check to see your likelihood of being audited.

If for some reason you are audited, you can get free help from TurboTax support, including information on notices, letters to write, and what to do next. The Audit Support Center includes lots of information for a DIY approach to handling an IRS audit.

If you want full representation if you are audited they offer TurboTax Audit Defense. They have partnered with TaxAudit to provide full-service audit assistance. You will be assigned an audit representative and they will handle all communications with the IRS including negotiations.

Is Turbotax Safe to Use

As with most tax software, TurboTax has serious security to protect your data. They use multi-factor authentication, which means you’ll get a single-use code whenever you sign into your account from a new device. To protect your account from fraud. You can also use Touch ID with the mobile app if your phone supports it.

Additionally, TurboTax uses SSL data encryption that goes above and beyond the IRS’s standards. And if important changes are made to your account, you’ll be notified immediately.

TurboTax Pros and Cons

Pros

- Easy to use — TurboTax is intuitive, has a great interface, and it helps you walk through all of your possible tax situations.

- Trustworthy — The software is reputable and you can count on it to be up-to-date with the latest tax laws. With TurboTax Assisted, you also can file your taxes with the assistance of a tax expert.

- Great for complicated tax situations — If you’re not sure how to file your taxes or which deductions you’ll be able to take to save money, TurboTax can guide you through this.

Cons

- More expensive than other programs — Generally the only con of TurboTax is that it is one of the pricier products on the market.

- Tax advice is extra — Customer service is only available for technical assistance. For tax expert advice, you’ll need to pay extra to upgrade to TurboTax Assisted.

Frequently Asked Questions (FAQ)

Is TurboTax Free?

TurboTax does have a free version that will allow you to file both federal and state returns for free. However, it is for simple tax returns only, and not all taxpayers will qualify.

If you only have W-2 income and are going to take the standard deduction then you will likely get it for free. If you have any complexity to your tax return including itemizing or having income that is not covered in a W-2 then you will likely have to upgrade to a paid version.

What Happens if My Return is Audited?

The IRS only audits 1% of tax returns, but if you are part of that unlucky few it can be quite a stressful time. Included with your TurboTax tax return is the Audit Support Guarantee. With this service, you have access to one-on-one question-and-answer support.

Here you can have your questions answered but it is informational only. They won’t talk to the IRS for you. If you want more support you can add on TurboTax Audit Defense for a fee.

How do I Contact TurboTax Customer Service?

Customer service is available through several channels. They offer an online forum where you can find many answers immediately. Or you can contact them online, via email, or by phone. They generally have good customer service reviews.

Remember, though, that technical customer service is different from their actual tax advice. If you need help with your taxes, you can ask the TurboTax Community but you’ll need to pay an additional fee for live tax expert advice.

TurboTax Alternatives

H&R Block

H&R Block has similar plans to TurboTax but they are slightly less expensive. Also like TurboTax, you can choose to add on features that cost a little more but will give you peace of mind knowing you have a tax professional helping you along the way.

For Do it yourself type plans:

- Free (simple returns only)

- Deluxe: $55 for federal and $37 for each state return

- Premium: $75 for federal and $37 for each state return

- Self-Employed: $110 for federal and $37 for each state return

If you want to file your taxes with help from a tax professional, they have just one plan that starts at $85 and presumably goes up from there depending on how complicated your taxes are. You can work with a tax pro virtually or in person. You can also just drop off your taxes and they will handle it for you.

The option to meet in person is not something that TurboTax offers. So if this is interesting to you may want to consider H&R Block.

TaxSlayer

TaxSlayer is the least expensive of all, they also have the simplest structure to their plans. Their two least expensive plans are DIY, their Simply Free plan is for simple tax situations and the Classic is for all others who want to DIY.

Their Premium plan offers everything in Classic but adds on priority support and the ability to talk to a tax pro.

Their Self-Employed plan gives you everything in Premium and also several features beneficial to someone self-employed, such as quarterly estimated tax payment reminders.

Their plans are:

- Simply Free: free federal and state returns for simple tax situations

- Classic: $19.95 for federal and $39.95 for each state

- Premium: $39.95 for federal and $39.95 for each state

- Self-Employed: $49.95 for federal and $39.95 for each state

Tax Slayer also has a plan for the military which allows for a free federal return but each state is $39.95.

One item of note is that TaxSlayer only offers audit support on the Premium version which includes information only. They will not speak to the IRS on your behalf.

Should You File Your Taxes with TurboTax?

TurboTax continues to offer user-friendly tax-filing software with features that make it stand out in a sea of options.

Because you don’t pay until you file, it’s easy to start with the free plan and upgrade as needed. So give it a try and see if TurboTax is the software you’ve been looking for.

TurboTax

Summary

TurboTax is the OG of online tax filing and they continue to offer the easiest-to-use platform that includes live support if you need it.