Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Sometimes you need cash fast. There have been times when you need quick cash to cover an unexpected expense or get you to the next payday.

We often think of payday loans as the place to turn to for quick cash.

However, that’s not always the best option. In fact, payday loans have extremely high-interest rates, and it’s easy to get trapped in a cycle of crushing debt. According to the Consumer Financial Protection Bureau (CFPB), the average effective interest rate on payday loans is nearly 400%.

What if you could access money quickly without the pain of those loans? Thanks to innovative technology, you can. The best payday loan alternatives on this list will front you some quick cash, often for free!

Best Payday Loan Alternatives

| Quick Loan App | Best For |

| Dave | Low Fees |

| Brigit | Budget Tools |

| MoneyLion | Existing Customers |

| Empower | Early Cash |

| Earnin | Quick Application |

| Chime | Overdraft Protection |

| Current | No Overdraft Fees |

| SoLo Funds | P2P Lending |

| Klover | Rewards Points |

| Digital Federal Credit Union | High Loan Amounts |

1. Dave

With an Extra Cash account from Dave, you can get up to $500 transferred to your checking account in 1-3 business days for no charge.

If you need the money instantly you can get a Dave Spend Account where you can instantly access the cash advance. This instant access costs 3% of the advance amount ($3 minimum).

The money will have to be paid back in full on your next payday, or the Friday following the loan if your payday can’t be determined. Partial settlements are allowed and Dave doesn’t charge late fees.

To get started, download the Dave app and link it to your bank account.

- Maximum advance amount: $500

- APR: N/A

- Fees: $1/month membership fee; no fee for ACH transfers, 3% (minimum $3) of advance amount for instant transfer to Dave Spend, 5% (minimum $5) for express transfer to external debit; optional tips

- Terms: Repayment on your next payday

2. Brigit

With Brigit, you can get up to $250 instantly delivered to your checking account. There is a monthly fee of $9.99 for the Plus plan, which will also require a fee to be paid for Instant Cash advances. However, if you sign up for the Premium plan at $14.99 per month, there is no fee for Instant Cash Advances.

To qualify you have to have your checking account for at least 60 days and have received three direct deposits to the account from the same employer. You also must keep the balance in your account above zero.

Exactly how much of an advance you can qualify for depends on your income, your spending patterns, and the average balance in your checking account. These factors are used to determine your “Brigit Score”. You can qualify for between $50 and $250.

Included in your monthly membership fee of $9.99 Brigit offers other services such as credit-building tools, identity theft protection, and opportunities to help increase your income. Brigit has no credit check and no late fees.

- Maximum loan amount: $250 advance

- APR: N/A

- Fees: $9.99 monthly fee; Instant Cash fee of $0.99 to $3.99

- Terms: Repayment on your next payday

3. MoneyLion

The MoneyLion Instacash feature lets you borrow up to $250 which is paid back when your direct deposit hits your checking account. There are no fees or interest, and no credit check to participate.

If you use an external checking account (as in not a MoneyLion account) the money will be available in 1-3 business days. If you have a MoneyLion checking account, called a RoarMoney account you’ll have your funds in 12 to 48 hours.

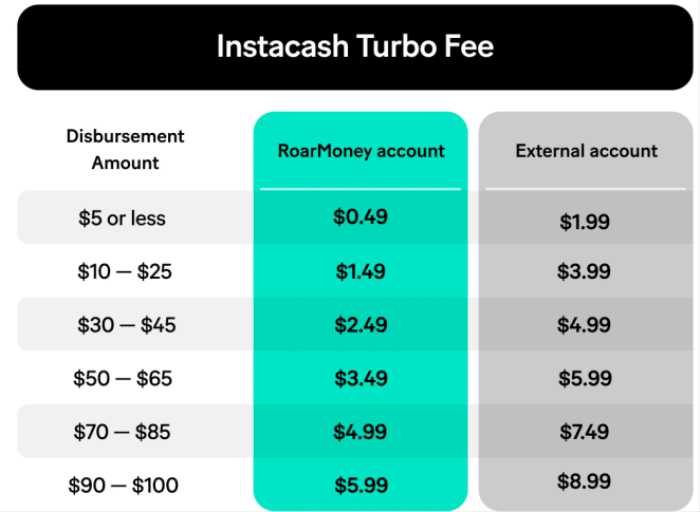

There is no fee for a cash advance using a standard transfer. But if you need funds within minutes, you can take advantage of Instacash Turbo. There is a fee for each advance taken using this method, which varies based on the amount of cash taken:

Also, with a RoarMoney account your direct deposit will arrive up to two days early, and enjoy access of up to $1,000 in instant cash advances. Which might also be pretty handy.

- Maximum loan amount: $500 cash advance

- APR: N/A

- Fees: None for standard transfers; $0.49 to $8.99 per Instacash Turbo transfer

- Terms: You set a repayment date when the required funds will be available

4. Empower

Empower offers Cash Advances of up to $250 with no interest. Empower will monitor your checking account and alert you if you are in danger of overdrafting the account. It will then offer you a cash advance to help you avoid the overdraft.

You can also request an advance at any time on the app.

There is a small fee associated with each Instant Delivery advance which will be between $1 and $8 depending on the amount of the transfer. There are no fees for standard delivery of an advance. There are also no late fees, interest payments, or credit checks for the advance.

When you get your next paycheck, Empower will deduct the amount it advanced to you to balance your account. Plus, if you deposit your paycheck to the Empower Card, instead of your personal checking account, you’ll also get your paycheck up to two days early.

- Maximum loan amount: $250 cash advance

- APR: N/A

- Fees: No fee for standard transfers; $1 to $8 for Instant Delivery, based on the amount of the advance

- Terms: Repayment on your next payday

5. Earnin

Earnin works a bit differently than the above companies. Earnin allows you to access wages you’ve earned but have not yet been paid for. They call this feature Cash Out.

You can let Earnin know how much you’ve earned in a few ways. One is to upload your timesheet to show what you’ve worked so far but haven’t been paid for yet. Another is to give Earnin access to your work email, which is monitored to determine how many hours you’ve worked. And lastly, you can verify your work address, which then uses your phone’s GPS to determine when you are at work.

You can have the money you’ve earned, but not yet been paid for, deposited into your account as an advance from Earnin. The money is then paid back when you receive your paycheck.

The app is free to use and advances have no interest or fees, but Earnin does ask for an optional “tip” when you request an advance. The amount that you choose it tip is completely up to you.

To get started, download the app and connect your bank account.

- Maximum loan amount: Up to $100 per day or $750 per pay period

- APR: N/A, but optional tipping up to $14

- Fees: None for a standard advance, $1.99 to $4.99 for a Lightning Speed advance

- Terms: Repayment on your next payday

6. Chime

Chime® has two features that can help you out in a pinch. First, Chime gives you access to your direct deposit two days early. Second, it has a feature called “Chime Spot Me®” which will automatically cover any overdrafts up to $200 without any fees.²

To use these features, you will need to set up direct deposit into a Chime Checking Account. For early direct deposit, your deposit will post to your account as soon as the money is available which could be up to two days early.

With the Spot Me feature you can overdraft your account from debit card purchases up to $200 with no fees. The advance is paid back with your next deposit. You can also give and receive “boosts” from friends where your friends can increase your Spot Me limit by $5 (and you can do the same for them) which is paid back with your next deposit. You can send and receive up to four boosts per month.

- Maximum loan amount: $200 overdraft protection

- APR: N/A

- Fees: None, but optional tip

- Terms: Paid back with your next deposit

7. Current

Not only does Current allow you to access your direct deposit early, but it also will allow you to overdraft your checking account by up to $200 without any fees.

You do need to have a Current checking account and your fee-free overdraft limit will start at $25 but your account will be reviewed periodically for an increase of up to $200.

You will also have to have a direct deposit of at least $500 per month and any overdraft will be paid back with your next deposit.

The Current checking account is free and has no minimum balance requirements, nor do they perform a credit check when you apply for an account.

- Maximum loan amount: $200 overdraft

- APR: None

- Fees: None

- Terms: Paid back with your next deposit

8. SoLo Funds

SoLo Funds is a member-supported financial community, enabling individuals to get advances of small amounts of money with no interest charges. Borrowers seek funds from other participants who lend funds on the platform.

Since it is a peer-to-peer platform, you can work out the details of your loan with a willing lender. Other than a 10% late fee if you fail to make your payment on time, SoLo does not have any fixed fees. There is a 1.75% fee for instant withdrawals, otherwise, funds can take up to three days to reach your account. There are optional tips you can make for up to 15% of the requested loan amount.

- Maximum loan amount: $575

- APR: N/A, but optional tipping up to 15%

- Fees: 1.75%

- Terms: Up to 35 days

9. Klover

Klover provides an advance of up to $200 against your next paycheck, with no interest charges. And like some of the other apps on this list, there is no credit check involved.

The standard advance amount is $100, plus you can earn up to $100 in additional advance ability by earning points. All app participants are eligible to earn points. Points can be earned by taking surveys, watching ads, and entering the daily sweepstakes offered on the platform.

To qualify to use the app you must have a positive balance in your checking account, participate in a valid periodic payroll system with consistent seven- or 14-day pay cycles, and receive paychecks of at least $250. Klover is not available to those who are self-employed or have other sources of irregular income. You can receive multiple advances, as long as each previous advance has been repaid.

- Maximum loan amount: $200

- APR: N/A, but optional tipping up to 20%

- Fees: $1.99 to $16.78 for Immediate Debit

- Terms: Repayment on your next payday

10. DCU Credit Union

DCU is a Massachusetts-based credit union, but it’s available to consumers nationwide. As an alternative to payday loans, they offer their Quick Loan. You can apply for a loan to get quick cash. There are no fees charged for the loan, and no credit check is performed. However, you must be a current member of DCU to apply for a Quick Loan.

The APR on the loan starts at 17.99%, but the credit union does not indicate a maximum rate.

To qualify for a Quick Loan, you must be a member of the credit union for at least 180 days. You cannot have more than one Quick Loan open at any time, and no more than three in a 180-day timeframe.

- Maximum loan amount: $2,000

- APR: From 17.99%

- Fees: None

- Terms: Up to 12 months

Get Quick Cash Other Ways

No matter which cash apps you use as a payday loan alternative, remember you’ll have to repay the amount you borrow. If you want to get quick cash in other ways, consider the following:

- Ask friends or family – If you just need a spot of cash to hold you over, friends or family might be willing to help you out–and it won’t usually cost you anything. Just make sure you repay them and use this method sparingly.

- Earn some quick cash – There are lots of ways to earn some quick cash, such as dog walking, babysitting, or even driving for apps such as Uber or Doordash. What’s great about this is that you don’t have to pay the money back. You’ve earned it.

- Sell something – Using a local Facebook sales group or apps like Let Go and 5miles, you can get rid of something you don’t need and get cash fast.

Related: How to Find Odd Jobs Near Me

How Payday Advance Apps Work

The idea behind payday advance apps is you’re receiving your paycheck early. The app determines how much you should have earned during your current pay period. For example, you might have worked several days, but your payday is still a few days away. Rather than waiting for your paycheck to get all the money at once, a payday advance app might front you between $100 and $500.

Once your payday comes, the money is repaid to the app. In general, these apps don’t charge interest, even though the advance might be considered a loan. However, you might need to pay a small fee or be asked to leave a tip.

To use a payday advance app, you usually have to connect your bank account. The app will use data in your account, including your normal income amounts and when you get paid, to determine how much of an advance you’re eligible for.

Finally, some apps charge membership fees and allow you to get a small advance and take as long as you want to repay the amount. However, until you repay the amount borrowed, you won’t be able to get more money.

Personal Loans

There may be times when a cash advance is just a bandaid and you actually need a longer-term fix. If so, you may consider a personal loan. Here are some options:

How We Compiled the Best Payday Loan Alternatives

We came up with this list of 10 payday loan alternatives based on the following criteria:

- A review of the various services offering payday loan alternatives.

- The ease with which those alternatives can be obtained, for example, checking account and credit requirements.

- Maximum loan amounts provided, whether in the form of a loan or a cash advance.

- Any interest rate charged on the amount advanced.

- Fees associated with the funds received.

- Repayment terms.

- The speed at which the funds can be received by the consumer.

Pros and Cons of Cash Advance Apps

When using a cash advance app, it’s important to understand that there are advantages and disadvantages associated with it. Before signing up, carefully consider whether the benefits outweigh the drawbacks.

Pros

- Access to fast cash when you have an emergency: Once approved, you have access to extra cash quickly.

- Most apps don’t charge interest: With a payday loan, you could end up paying what amounts to a 400% APR. Many cash advance apps charge a small fee rather than interest, which can even be cheaper than a credit card cash advance.

- Once approved, you can keep using the app: While you have to go through an approval process, once you go through it, you can keep using the payday advance feature. This differs from a loan, which requires you to reapply each time you need more money.

Cons

- Need approval: Before using one of these apps, you need to get approval and connect your bank account. Depending on the app, you might also need to go through your employer. Some apps work with employers for payroll advances and you can’t use the program if your company isn’t enrolled.

- Amounts are usually small: In many cases, you’ll only be able to get $100, $250, or $500 instantly. While these amounts can be helpful to cover minor, short-term issues, they won’t take care of more significant emergencies.

- You could get caught in a cycle: Another issue is that it’s relatively easy to get caught in a cycle of remaining behind. It can become too easy to get advances and constantly use the money you don’t have yet. While these easy payday loan alternatives could be helpful, they could also enable your poor spending habits.

Frequently Asked Questions (FAQ)

What are better alternatives to using payday loans?

In addition to the payday loan alternatives we’ve included in this guide, you should also consider obtaining funds from family and friends, seeking a payroll advance from your employer, applying for a bad credit personal loan (if you have impaired credit), or even seeking funding from various charities and government agencies in your area.

How can I get instant cash without a loan?

If you would prefer not to borrow money from any source at all, you’ll need to consider procuring additional funds. The fastest way to do this is by selling unused items for cash. Next will be to use any skills you have to earn additional money, such as landscaping or house cleaning. Finally, consider selling any unused gift cards you have. You can do that through websites such as CardSell or CardCash.

How can I borrow $100 instantly?

Most of the apps included in this guide will enable you to borrow $100 or more instantly.

How do I get instant money for an emergency?

The answer to this question really depends on the amount of money needed to cover the emergency at hand. But for larger amounts, you may need to consider getting a personal loan from a credit union. DCU’s Quick Loan is an excellent choice since it will provide up to $2,000 in funds for an emergency.

Bottom Line

Before you turn to payday loans, whether you look online or offline, consider other ways to get the cash you need to handle an emergency. With interest above 200% APR – some even going above 600% APR – payday loans are extremely expensive.

The alternatives on this list are often free or extremely inexpensive, oftentimes only a few dollars. If you just need an occasional float these payday loan alternatives and the best money instant apps can save you a lot of money.

Related: Best Buy Now, Pay Later Apps