Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

The decision to pay off your mortgage early is a controversial one. But for some who have tackled many of their big financial goals and erased other debt, putting their home mortgage in their crosshairs can make sense.

Since your mortgage is such a large, long-term debt, it can be surprisingly easy to pay it off at least a little early. You might get out of a year’s worth of payments (or more) simply by throwing a bit extra toward your principal each month.

Some of these options will have you paying off your mortgage a decade or more early. Others will cut just a few months or years off of the debt. Either way, any of these options could save you money in the end and help you reach financial freedom faster. If your budget allows, consider using a combination of these approaches to really hit that debt hard.

1. Refinance to a 15-year mortgage

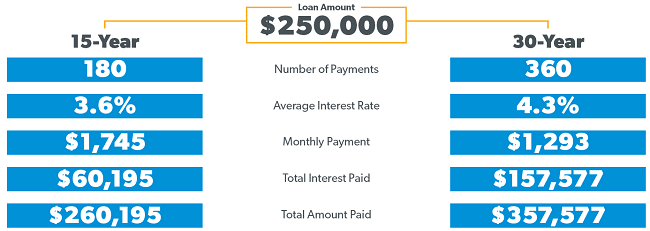

An easy way to guarantee that you’ll pay off your house twice as fast is to refinance your mortgage from a standard 30-year term to a 15-year term.

If you refinance to a 15-year mortgage, you’ll typically pay a lower interest rate while making larger payments each month. But here’s the thing: since your term is so much shorter and the interest rate is likely much lower, you won’t pay anywhere near double your current mortgage payment.

Refinancing to a 15-year mortgage could save you hundreds of thousands of dollars in interest over the life of your loan, besides getting rid of mortgage payments much sooner. You’ll have to check out current estimated mortgage rates to see just how much this refinancing process could save you.

Related: 6 Things You Need to Know Before You Refinance to Pay Off Debt

What’s the downside of this option? You get locked into a higher monthly payment, which gives you less flexibility in your budget. With a 30-year mortgage, you have lower payments, but you could always pay extra to get out of the loan sooner.

When you refinance to a 15-year mortgage, you’ll get stuck in the higher payment. Plus, you’ll have to deal with the actual costs of refinancing. Then, if your income fluctuates for any reason, you may struggle to deal with the higher mortgage payment.

For this reason, you should definitely take time to consider whether or not refinancing a 30-year mortgage 15 years is the best option for your needs. If you have plenty of room in your budget to cover the increased payments, it might be. But if you’re currently working on other competing financial goals, refinancing to a shorter term may not be your best bet.

2. Refinance, but keep the same payments

Many who refinance do so to reduce their monthly payments. But if you refinance, you can double up by reducing your interest rate and continuing to make the same monthly payment.

This has the same result as making extra payments each month on your current mortgage but gives you a lower required payment. That means you have more budget flexibility and can pay more towards your mortgage principal each month without ever-increasing your payment.

Just how powerful this option could be depends largely on your current interest rate and your new interest rate. This calculator allows you to plug in the details of your current and future loan to show you how much you stand to save every month.

Unfortunately, while this method is probably the most common way to pay off your mortgage early, it’s also going to be more expensive in today’s rate environment. We’re currently on a rising rate schedule, meaning new rates are higher than old rates and your chances of locking in a lower monthly payment by refinancing to another 30-year mortgage are not good.

For now, it is probably best to wait until mortgage rates cool down and then when you see rates lower than your current mortgage, considering locking in a refinance.

Learn More: Retiring Early? Why You Should Pay Off Your Mortgage First

3. Use pay raises on your mortgage

One way to find extra cash to put toward your mortgage is to apply for raises and bonuses from your job.

The goal is to put the same percentage of your income toward your mortgage, even when your pay goes up. In other words, if you’re currently putting 15% of your income towards your mortgage payment, 15% of each annual raise amount should also go toward your mortgage, in addition to what you’re already paying. If you’re already leading a comfortable lifestyle and can avoid lifestyle inflation that often follows a raise, you can put your whole raise amount towards your mortgage balance.

This strategy works best for those who get regular raises over and above the minor cost of living adjustments. If you aren’t expecting to see your income increase anytime soon, this strategy might not be the best option to start with.

4. Pay extra each month

Fifty bucks might not be much in your budget, but consistently adding this much to your mortgage payment can make a big difference.

What if you have that same $200,000 mortgage at 5.5% interest? Maybe you decide not to refinance (perhaps because rates are higher today than when you took out your first mortgage), but instead, just put extra money towards your mortgage each month.

Add only $50 per month to your mortgage payment, and you’ll pay it off in just over 27 years, saving about $24,162 in interest. That’s a pretty big difference, for less than the cost of a nice dinner on the town each month.

The biggest problem with this approach, though, is that it requires willpower. To reap those benefits, you have to voluntarily put an extra $50 towards your mortgage payment every month.

Related: 8 Strategies for Stressing Less About Retirement

5. Use cash windfalls to pay lump sums

Instead of paying a little extra each month, you could pay a large lump sum here and there. This can be done with a cash windfall, such as from a yearly tax refund, work bonus, or inheritance.

Just how big of a difference a windfall can make depends on its size. But the good thing about these payments is that you can apply them directly toward the principal of your loan. So if you put $3,000 towards your mortgage’s principal in April when you get your tax check, all of your payments from there on out are a little more effective, because less of them are going towards interest.

How much you’ll save in interest by making a one-time large payment depends on the interest rate and how long you’ve had the mortgage. The higher the rate and earlier the mortgage, the more you’ll save in interest by making this payment. And more often than not, you amount you pay will save you MORE in interest. For example, on your first mortgage payment, you paid an extra $10,000.

On a 30-year $300,000 mortgage with a 6.00% interest rate, that $10,000 payment would save you almost $19,000 in paid interest throughout the loan!

6. Make biweekly payments

If you opt to make biweekly payments on your mortgage, you’ll make an extra mortgage payment every year. Making 26 payments a year with our example cuts almost five years off a typical 30-year mortgage.

There are a couple of ways to do this. You can manually log in to make 1/2 of your mortgage payment every two weeks. This is great if it aligns with when you get paid! Or you can use a free bill pay service to set up automatic payments for this purpose.

If you’d rather stick to making your payments monthly, just add 1/12 of a monthly payment to each payment, and you’ll reap the same benefits of biweekly payments.

Learn More: Cut Expenses Now

7. Set a target payoff date

Setting a target payoff date allows you to know exactly how much extra to pay each month to be mortgage-free by a certain date. You’ll have the added motivation of marking your calendar to plan the celebration.

Let’s say you want to pay off that $200,000 mortgage in 18 years when your child goes to college. You’ll need to put an extra $325 towards your payment each month.

What if you want to pay off your mortgage in 10 years? You cannot quite double your payments to $1,035 to achieve this goal.

8. Combine methods

There’s no need to select only one method from this list. Many mortgage holders can choose a few options on this list and combine them to pay off their loan even earlier. Let’s say you apply an extra $200 each month as well as your $3,000 tax refund every April — you’ll see double the benefits, and pay off your mortgage even faster. In the personal finance world, every penny saved is a penny earned… so, go save yourself some interest and pay off that mortgage early!

Should you pay off your mortgage early?

Now that you know how you can pay off your mortgage early, the question becomes whether or not you should. Mortgages are generally considered low-interest debt so if you have enough cash to pay it off, you should first make sure you have no other high-interest debt. If you still have credit cards, personal loans, or business loans, those need to go first.

If your mortgage is the only debt you have, then the picture becomes clearer. Still, however, you should consider whether or not the cash you’re investing in paying off your mortgage could be better used elsewhere. For example, I currently have a 30-year mortgage at a fixed rate of 2.5%. I can find a 12-month CD currently paying 5.5% APY, so it would be silly of me to put my money into the mortgage when I can find a much better return on a CD.

My situation, however, is not common considering how high today’s rates have become. If your mortgage rate is higher than that of the best CD rates and you believe you’ll save more by cutting down future interest costs, it may be time to pay off your mortgage.