Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

Staying ahead of your budget these days is no easy task. There once was a time when all of your banking was done with just one brand but today, you’re more likely to have accounts with dozens of different banks, credit card companies, and investment providers.

Quicken is a budgeting software that can help you manage it all. They’re the oldest personal finance management software company and have been helping consumers pull financial reports longer than anyone. We’re going to take a deep dive into Quicken and see whether or not paying a small monthly fee is worth the features they provide.

Quicken Review 2024

Quicken is basically accounting software but for personal use. At its core, it is a budgeting tool but it doesn’t stop at budgeting. You will set a budget, with categories, limits, savings goals, etc., and then track all of your income and expenses against this budget by categorizing and tagging transactions.

By linking your bank accounts to the software your transactions will pull in automatically making it very easy to track your income and outflow. It will also track your bills and, depending on the package you choose, allow you to pay your bills right inside Quicken.

It also has investment tracking features, as well as revenue and expense tracking for a small business or rental property.

Where Quicken really shines is in its reporting capabilities. You can pull reports for just about anything you’d want to see.

Quicken Pricing and Fees

Quicken has several plans, each with different levels of features. They include:

- Simplifi – $2.99 per month

- Quicken Deluxe – $2.50 per month

- Quicken Classic – $3.50 per month

- Quicken Home and Business – $5.00 per month

All plans can be used on the desktop or mobile app and come with phone and chat support.

If you want the basic features such as creating a budget and tracking your spending either Simplifi or Quicken Deluxe will work for you, although with a discount for paying annually, the Deluxe version is almost the same price as Simplifi and gives you a lot more features.

Premier and Home and Business is where the feature really starts to pick up. Premier is best for users who also want to track their investments and Home and Business adds-on features that will help you file taxes if you own rental property or a business.

Your Quicken Dashboard

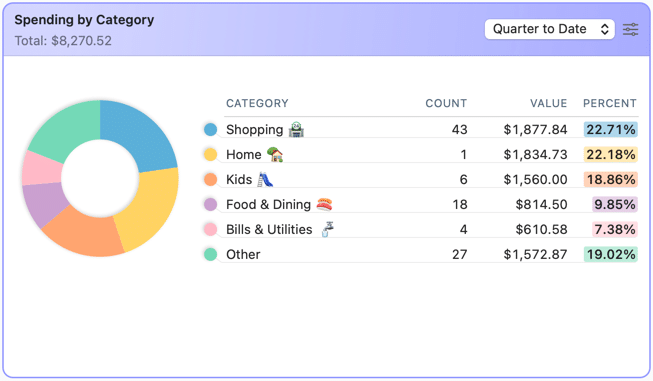

Your Quicken dashboard is where you can get a quick view of the information that is most important to you. You have various “cards” you can choose to show on the Dashboard and then each of those cards can be customized so you are seeing exactly the info you want.

For example, you could choose to see your expenses compared to your income. Or how much you’ve spent at various retailers or vendors. You could also add a card for your top investment performance or track your net worth over time.

[Image quicken spending categories]

Tracking Income and Expenses with Quicken

Tracking your income and expenses is at the heart of Quicken.

With all levels of Quicken, you can create a budget and plan your spending. If your accounts are connected to Quicken the software will automatically pull in all of your transactions. You can then categorize and sort these transactions against your budget so you always know where you stand in each category.

Quicken allows you to create custom categories, tag transactions so you can see all types of transactions easily even if they are in different categories, split transactions in multiple categories, and add notes to transactions.

You can also use Quicken to track and pay your bills. All plans will allow you to track your bills and project your cash flow, however only Premier and Home and Business have access to the bill pay service within Quicken.

How Does Quicken Help You Plan Your Future

Quicken’s robust budgeting features ensure that you are using your money to reach your financial goals. You can set spending and savings goals and track your progress against those. You can also forecast and do long-term planning within Quicken.

Every level of Quicken, except for Quicken Starter, will track your net worth, loan, and investment balances, including any 529 accounts, 401(k)s or IRAs, and your home value. Home and Business will even pull your home value directly from Zillow.

Using Quicken for Investment Tracking

If you want to track investments via Quicken Premier or Home and Business is likely your best bet. Simplifi and Dexlue have some basic investment tracking features, such as pulling in your balances across various institutions, but the higher-level plans are where it gets interesting for active traders.

Premier Home and Business both display live security prices which update every 15 seconds. They also allow you to see what the tax implication of buying or selling a security would be, including a “what if” calculator for estimating capital gains. You can also use Morningstar’s Portfolio X-ray tool right inside Quicken.

Read more: Best Way to Track Your Investments Online for Free

Tax Help with Quicken

Quicken makes tracking your expenses easy, which in turn can make your taxes a lot easier. Being able to categorize and tag transactions lets you quickly run reports and see all of your deductible expenses.

For example, you could tag your charitable giving and unreimbursed work expenses throughout the year and then run a report at tax time that will give you the details you need to file for those deductions.

If you want real help with your taxes you’ll likely want either the Deluxe, Premier, or Home and Business options, these packages offer. These packages offer more specialized tax help.

For those who itemize, Deluxe, Premier, and Home and Business will even create your schedule A reports.

If you use Quicken to track your investments you’ll also be able to see your capital gains. If you have interest or dividends you need to report, Deluxe, Premier, and Home and Business can also create your Schedule B reports.

The Home and Business package also can create your Schedule C report so you can report your small business income and Schedule E if you need to report income from a rental property.

Starter, Deluxe, Premier, and Home and Business will all import into Turbo Tax to make your taxes even easier.

Quicken Reports

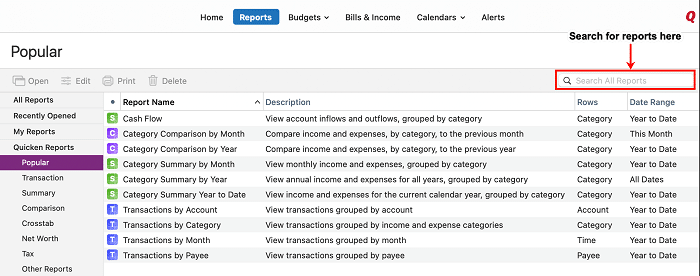

Quicken has a robust reporting feature. You can get a multitude of reports, anything from your net worth to how much you spent on pizza last year — and how that compares to previous years.

You can run reports over any chosen time period and cover just about any data points you need. The reports are customizable and you can save your favorites so they are easy to run again with all your individual preferences so you don’t have to customize them each time.

How to Get Started with Quicken

To sign up for Quicken, you just have to create an account at Quicken.com, decide which version you want to use, and download the desktop version. You’ll want to download the desktop version even if you plan to use Quicken mainly on the web. The two are synced, so having the latest desktop version ensures that everything works properly online.

Once you’re in, you can walk through each tab to set up Quicken, including syncing it with your bank accounts if you decide to do that.

Quickens Synchronization

Quicken actually has a couple of different types of synchronization. One is with your bank, should you choose to use it, and one is to the Quicken Cloud.

Quicken Bank Synchronization

Quicken can securely sync with your bank and investment accounts if you choose to set this up. This means it can automatically pull in balances, transactions, and investment performance. In my opinion, this is one of Quicken’s strengths. Many people are more likely to stick to budgeting each month if they don’t have to hand-enter transactions. Here’s more information from Quicken on syncing your accounts.

Note, though, that you don’t have to set up Quicken to sync with your bank accounts. You can do all of the transactions manually if that’s your jam.

Quicken Cloud

The Quicken Cloud keeps your data in sync between the desktop version, Quicken Mobile, and Quicken on the web. If you want to keep your data on the desktop only, you can turn it off if you’d prefer. However, it is a convenient option for ensuring you can access your financial information wherever you are.

Is Quicken Safe to Use

Yes, Quicken is safe to use. It uses bank-level security, so it’s as safe as any banking online you already do. Quicken provides a secure encryption technology that scrambles your personal information and financial data while it’s sent over the internet. It also uses multiple firewalls and checks to ensure that your data stays secure. You can also password-protect your data files in Quicken for an additional layer of security.

At the same time, it’s important to remember that no online system is completely risk-free. You should always be aware of who has access to your account and take measures to protect yourself from fraud. Make sure you use a strong password and change it frequently, never share your login details with anyone, and review your account activity regularly. By following these steps, you can help ensure that your Quicken account remains safe and secure.

Quicken Security

As with many financial products, Quicken uses bank-level 256-bit encryption to keep your data secure. It also uses multiple firewalls and checks to ensure that your data stays secure as it’s coming into Quicken. You can also decide to password-protect your data files in Quicken for an additional layer of security.

Quicken for Mobile

Quicken does have a mobile app that works with Apple and Android phones. The app is similar to the web service. It gives you access to your most important financial dashboards and data. On mobile, you can store receipts via your phone’s camera and enter transactions as you spend. You can also check out your budget to ensure that you’re not overspending when you’re out and about.

As with the desktop and web versions, the mobile app is protected by a passcode and 256-bit encryption. You can also add more protection using Face ID or Touch ID.

You can’t completely run and set up Quicken from your mobile app. But if you get everything set up on the desktop version, you can do the most essential financial data entry and management from mobile.

Quicken Pros and Cons

Pros

- Robust budgeting tools

- Bill tracking, reminders, and bill pay. Always know what is due and when.

- Automatic net worth tracking. It will pull in balances from a wide variety of accounts and display them all in one place.

- Full reporting capabilities. Quicken has a large variety of fully customizable reports.

- Forecasting and long-term planning capabilities. You can see how different choices will play out over the long run.

Cons

- Relatively expensive, a lot of what Quicken does can be done with free tools but not all in one place.

- Can be overwhelming. Quicken has a lot of features and options which can lead to a learning curve.

- Not as intuitive as competitors.

Quicken Alternatives

Rocket Money

Rocket Money does a terrific job of detailing your daily spending while offering excellent budget tools to keep your finances in order. The platform charges between $4 and $12 a month for its premium services (you choose within that range how much to pay) but does offer its basic service for free.

You can set up automatic alerts and with the premium service, request your subscriptions to be canceled (or reduced in price). I prefer the Rocket Money dashboard to the Quicken dashboard but both are excellent options. With Rocket Money, you can link an unlimited number of personal accounts.

Tiller

Tiller is another personal finance budgeting platform but it’s a little different than both Quicken and Mint. Tiller allows you to create spreadsheets that you can customize in any way you desire. After connecting your financial accounts to Tiller, the software will automatically update your spreadsheets every day. You receive the information you want, in the way you want it.

Tiller offers a 30-day free trial to start, which allows you some time to play around with your spreadsheets and design the best delivery method possible. You do have to have a little bit of Excel knowledge in order to take full advantage of Tiller and after the free trial ends, the cost is an annual fee of $79.

Read more: Alternatives to Quicken that are Easy to Use

Bottom Line

Quicken is an old hand at the budgeting and financial management game, and it seems to be doing a better job in the last couple of years of keeping up with its newer competitors. It does basically everything you would need a financial management tool to do, including managing both budgets and investments.

With that said, it can have a steep learning curve because it is so robust, so if you don’t want to spend a lot of time managing your finances at first, you might opt for a simpler, more streamlined system.

Quicken

Summary

Quicken is a leader in the personal finance management space and their software plans to track and manage your budget are an excellent choice.