Editorial Note: We earn a commission from partner links on Doughroller. Commissions do not affect our authors’ or editors’ opinions or evaluations. Learn more here.

I grew up learning many financial lessons from my parents. Unfortunately, most of these were learned by watching my parents make bad decisions that I was determined not to repeat. We didn’t have much financial education in school, with only a few days dedicated to writing a check and calculating interest.

Parents today have the opportunity to do so much more for their kids’ future, and they have incredible tools—like the best money apps for kids and teens—to help them do it. These apps allow parents to pay their children for chores or allowance, track their spending, teach them about saving and budgeting, and even guide them into their first investments.

Best Money Apps for Kids and Teens

| Money App | Best Feature |

|---|---|

| GoHenry | Customizable debit card and financial education tools |

| FamZoo | Simulates real-world banking in a family environment |

| Greenlight | Debit card for kids with spending controls and education |

| BusyKid | Chore-based earnings with saving, spending, and investing options |

| Homey | Assigns monetary value to chores for financial responsibility |

| Acorns Early | Investing spare change for kids |

| Fidelity Youth | Real-world investing experience for teenagers |

| iAllowance | Tracks cash and non-cash transactions, setting financial goals |

1. GoHenry

GoHenry offers a multifaceted approach to financial education for kids, presenting a blend of practicality and innovation in managing personal finances from an early age. First, it provides a hands-on experience with money management through a customizable debit card, allowing children to earn, save, and spend under the guidance of their parents. This direct involvement fosters financial literacy by teaching budgeting, saving goals, and the value of money in a controlled environment.

Additionally, GoHenry incorporates educational tools and resources designed specifically for young users to learn about financial concepts in a fun and engaging way. The app also enables parents to set spending limits, monitor transactions, and create tasks for their kids to earn money, thus promoting a sense of responsibility and independence. Moreover, real-time notifications and detailed spending reports help parents track their children’s financial habits, providing peace of mind and opportunities to discuss financial decision-making.

By combining these features, GoHenry stands out as a powerful tool for instilling healthy financial habits in children, preparing them for a future of financial confidence and competence.

- Monthly Cost – $4.99 per child per month or $9.98 per month for the family plan (up to 4 children)

2. FamZoo

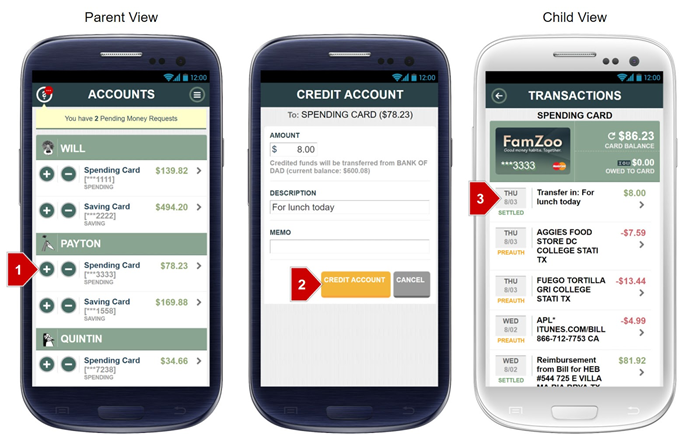

Famzoo teaches financial proficiency among kids and teens by simulating a real-world banking experience within a safe, controlled family environment. A key benefit of FamZoo is its ability to offer prepaid cards for each family member, allowing parents to teach their children about spending, saving, and giving in a practical, hands-on manner.

Through the app, parents can set up automatic allowances, chore rewards, and even interest in savings to motivate kids to save money rather than spend it impulsively. One of the standout features of FamZoo is its flexibility in teaching about financial responsibility; it allows for creating customized spending rules, savings goals, and charitable giving plans, thereby imparting valuable life lessons on budgeting and the importance of financial planning.

Additionally, FamZoo encourages family collaboration by facilitating money requests and transfers among family members, thus teaching children how to manage money in a context that mirrors adult financial interactions. The app also includes educational resources and quizzes to enhance financial knowledge further.

With its comprehensive tools and educational content suite, FamZoo is an excellent platform for preparing young individuals for financial independence. It is a valuable asset for families looking to instill sound financial habits in their children.

- Monthly Cost – $5.99 per month, but discounts are available for paying in advance. The best discount is paying $59.99 for 24 months ($2.50 per month)

3. Greenlight

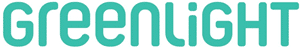

Greenlight provides a comprehensive financial education and management platform for young users and their families. One of its standout features is the ability to issue a debit card for kids, which parents can control through the app. This enables parents to allocate funds to specific spending categories, encouraging kids to make budget-conscious decisions.

Greenlight enhances your child’s ability to manage money by offering one of the best bank accounts for kids. Saving, spending, and earning are all under parental supervision. The app’s saving feature promotes goal-setting by allowing kids to save money for future purchases. In contrast, the earning feature can be used to manage chores and allowances to teach kids about working for money. Moreover, Greenlight includes educational content designed to teach kids about important financial concepts in an age-appropriate manner.

The app also offers investment opportunities for kids, introducing them to the basics of investing, a feature not commonly found in other kids’ finance apps. With customizable controls, real-time alerts, and detailed spending tracking, Greenlight offers a secure environment for kids to learn about and practice financial management, preparing them for a successful financial future.

- Monthly Cost – Greenlight offers three plans, each with a different monthly cost.

| Plan Name | Savings Reward | Investing Available? | Location Tracking? |

| Core | 1% | NO | NO |

| Max | 2% | YES | NO |

| Infinity | 5% | YES | YES |

4. BusyKid

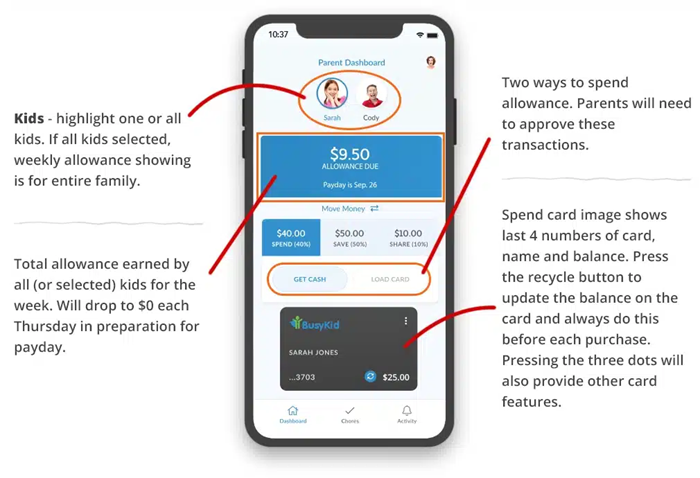

BusyKid is a pioneering tool for integrating practical financial management skills into children’s everyday routines. At its core, BusyKid emphasizes the value of earning through a chore-based system, where kids can complete assigned tasks to earn their allowance. This direct correlation between work and reward lays a solid foundation for understanding the principles of earning money in the real world.

Additionally, the app encourages financial literacy by allowing children to allocate their earnings into categories such as saving, spending, sharing, and even investing, introducing them to a broad spectrum of financial activities from a young age. One of the unique benefits of BusyKid is its investment feature, which offers children a simplified introduction to the stock market, enabling them to buy shares of real companies. Thus, the app demystifies investments and offers an early interest in financial growth.

Furthermore, the app includes a charitable giving option, teaching kids the importance of generosity and social responsibility by allowing them to donate a portion of their earnings to various charities. With its comprehensive approach to financial education, BusyKid equips children with essential money management skills and instills values of hard work, saving, and philanthropy, preparing them for a well-rounded financial future.

- Monthly Cost – 30-day free trial and then $4 per month, billed annually.

5. Homey

Homey is an innovative platform designed to instill financial responsibility and work ethic in young individuals through household chores and tasks. Homey effectively teaches children the value of earning their allowances by assigning monetary or point-based rewards to daily chores, linking hard work to financial gain.

This approach not only encourages a strong work ethic but also introduces children to the basics of financial management, including saving, spending, and budgeting. One of the app’s key benefits is its ability to create a collaborative family environment where tasks and goals are shared, promoting teamwork and accountability among siblings. Plus, Homey provides a visual progress tracking feature, enabling kids to see their accomplishments over time, which can be highly motivating.

The app also supports saving for goals, allowing children to allocate their earnings toward specific savings targets, thereby teaching them the importance of delayed gratification and saving for the future. In addition, Homey offers parents the flexibility to customize rewards and tailor the app’s use to their family’s specific needs, making it a versatile tool for teaching kids about money from an early age.

- Monthly Cost – $4.99 per month or $49.99 per year if charged annually.

6. Acorns

Acorns Early trading account for kids offers a seamless educational gateway into investing, providing a solid foundation for investments and growth from a very young age. Acorns Early is part of the Acorns family investing program, designed to allow parents to invest in diversified portfolios on behalf of their children, thereby setting them up for future financial success.

The account automatically invests spare change through a feature known as “round-ups,” making investing easy and accessible. This simplifies the investment process and demonstrates the power of compound interest over time, teaching kids the value of saving and investing from whatever they earn or receive as gifts.

Acorns Early grows with your child, offering options to transfer the account to them once they reach adulthood.

The platform also provides educational content tailored to parents and kids, making it a valuable resource for learning about financial concepts and the importance of investing for the future. By starting an Acorns Early account, parents can instill in their children the importance of financial foresight, making it a practical tool for building a strong financial foundation.

- Monthly Cost – Acorns offers three monthly plans that charge $3, $5, or $9. The first month is free with Acorns Premium (the $9 plan).

7. Fidelity Youth

Opening a Fidelity Youth Account offers a unique opportunity for teenagers to gain real-world financial experience while still under the guidance of their parents. This account is specifically designed for individuals aged 13 to 17, allowing them to invest in stocks, ETFs, and Fidelity mutual funds without commission fees, thus providing an early interest in investing and the stock market.

One of the standout benefits is its educational component; Fidelity provides access to a wealth of financial education resources tailored to young investors, helping them make informed decisions and understand the basics of investing. Additionally, the account comes with a debit card, giving teens the autonomy to manage their spending and savings while teaching them about the responsibilities of a bank account.

Parents have visibility into the account’s activities, enabling them to oversee their teen’s financial decisions without directly controlling the account, promoting independence and financial responsibility. The Fidelity Youth Account serves as a practical bridge between theoretical financial education and actual financial management, preparing teens for a future of informed and responsible money management.

- Monthly Cost – No subscription fees, monthly maintenance fees, or minimum balances are required.

8. iAllowance

iAllowance is an innovative tool designed to help children understand and manage their finances effectively from a young age. One of its core benefits is the app’s ability to track cash and non-cash transactions, enabling kids to manage their allowances, chore money, and gifts in one convenient platform.

iAllowance promotes financial responsibility by allowing parents and children to set up regular allowance schedules, savings goals, and spending limits. Its unique feature of rewarding children with stars or other non-monetary rewards for completing tasks or achieving goals adds a gamified aspect to financial learning, making it more engaging for young users.

Finally, the app supports multiple children, making it easier for families to manage each child’s finances separately while encouraging an environment that allows children to improve their financial education. With its intuitive interface and comprehensive tracking capabilities, iAllowance teaches kids the value of money and savings and prepares them for a financially responsible future.

- Monthly Cost – The download is free, and there is a one-time upgrade, which costs $2.99. One-time add-ons are also available for $0.99.

Five Benefits of Money Apps for Kids

If you’re unsure whether your child would benefit from a money app, here are five primary reasons it’s typically a great idea.

- Financial Literacy: Money apps introduce kids to the basics of personal finance, including saving, spending, budgeting, and investing engagingly and interactively. This early education can help them make informed financial decisions as they age.

- Money Management Skills: By using these apps, children learn how to manage their allowances, earnings from chores, or any money gifts they receive. They learn to set savings goals, monitor their spending habits, and understand the value of money.

- Responsibility and Independence: Handling their own money through an app can strengthen a sense of responsibility and independence in children. It gives them a safe space to make financial decisions, learn from their mistakes, and understand the consequences of their actions without risking significant loss.

- Tech Savvy: In today’s digital world, using technology is vital. Money apps help kids become comfortable with using digital tools and platforms, which is a skill that will benefit them in many areas of life.

- Engagement and Fun: Many money apps for kids are designed with fun, colorful interfaces and include gamified elements. This makes learning about money enjoyable and engaging, increasing the likelihood that kids will want to continue learning and exploring financial concepts.

By incorporating these apps into their routine, children can develop a healthy relationship with money, understanding its value and how to manage it effectively, which can lead to lifelong financial wellness.

Frequently Asked Questions (FAQ)

What features should I look for in a money app for kids and teens?

When choosing a money app for kids and teens, look for features that align with educational goals for financial wellbeing. A good app should offer an interactive and engaging platform that teaches the basics of money management, saving, spending, and even investing. It should be user-friendly and appropriate for their age group, with parental controls that allow for monitoring and setting limits.

The ability to set savings goals, track spending, and receive real-time notifications can also be beneficial. Additionally, some apps provide chores and tasks kids can complete to earn money, integrating practical financial lessons with their daily lives.

Are money apps for kids and teens safe?

Safety is a paramount concern with any app used by children and teens. Reputable money apps for this age group are designed with security and privacy in mind. Look for apps that are compliant with the Children’s Online Privacy Protection Act (COPPA) and have robust security measures, such as encryption and secure data storage.

Parental oversight features are also crucial, allowing parents to monitor activity and transactions. Before downloading an app, it’s advisable to read reviews, check its privacy policy, and understand what information it collects and how it’s used.

Can using a money app help my child develop better financial habits?

Using a money app can significantly help your child develop better financial habits. These apps are designed to teach kids and teens about their money in an accessible and engaging manner. By managing their own money through the app, kids learn the value of saving, the importance of budgeting, and the consequences of their spending decisions.

Many apps also introduce concepts like charitable giving and investing, broadening their understanding of how money can be used. These lessons’ interactive and real-world application helps instill a sense of financial responsibility and confidence that can last a lifetime.

Final Thoughts on the Best Money Apps for Kids and Teens

Deciding whether or not to open a money app for your child hinges on several factors, including your child’s age, level of maturity, and the specific goals you have for their financial education. Money apps can be a powerful tool for teaching financial literacy, offering a practical, hands-on approach to managing finances that textbooks or lectures can’t match.

They can demystify complex topics like saving, investing, and budgeting, making them accessible and engaging for children. Additionally, these apps often come with features that allow parents to monitor transactions, set limits, and guide their child’s financial decisions, ensuring a safe and controlled environment for learning.

However, it’s important to approach this decision with caution and consideration. Introducing a money app too early, or without proper guidance, could lead to a misguided perception of digital money — for instance, not understanding the value of hard-earned cash or becoming overly focused on spending. Assessing whether your child is ready to take on the responsibility and understand the introduced concepts is essential.

Additionally, choosing the right app is crucial; it should align with your family’s values and financial practices and offer the right balance of control, autonomy, and educational content. If used wisely, a money app can be an invaluable addition to your child’s education, equipping them with the skills and knowledge to navigate the financial world confidently.